All Categories

Featured

State Farm agents market everything from homeowners to vehicle, life, and various other preferred insurance products. So it's very easy for agents to bundle services for discounts and simple strategy monitoring. Many customers delight in having actually one relied on representative handle all their insurance policy requires. State Farm uses universal, survivorship, and joint global life insurance policy plans.

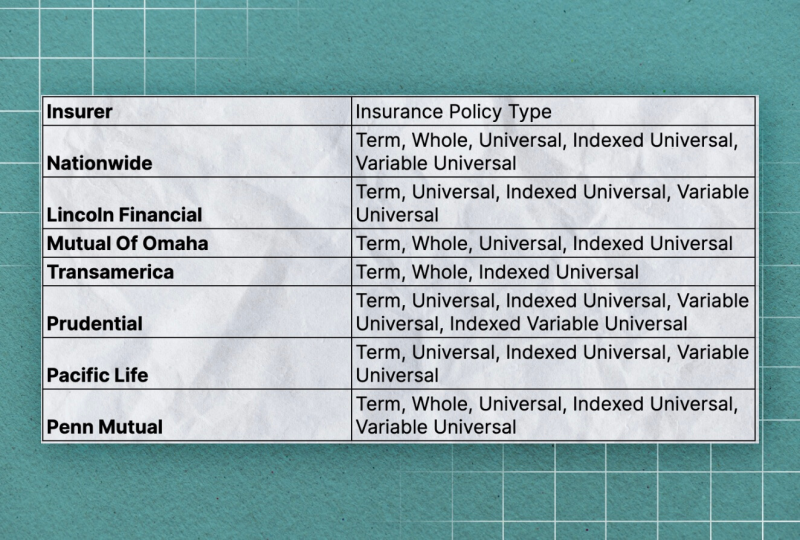

State Farm life insurance coverage is usually conventional, using stable alternatives for the average American household. Nonetheless, if you're seeking the wealth-building chances of global life, State Farm lacks competitive alternatives. Read our State Farm Life Insurance review. Nationwide Life Insurance Policy offers all sorts of global life insurance policy: universal, variable universal, indexed universal, and global survivorship policies.

Still, Nationwide life insurance policy plans are very available to American families. It aids interested events obtain their foot in the door with a reliable life insurance coverage plan without the much a lot more difficult discussions regarding financial investments, financial indices, and so on.

Also if the worst happens and you can not get a bigger plan, having the protection of a Nationwide life insurance coverage plan could transform a buyer's end-of-life experience. Insurance coverage companies utilize medical tests to assess your risk course when applying for life insurance coverage.

Customers have the choice to alter prices each month based on life circumstances. A MassMutual life insurance representative or economic consultant can aid customers make plans with area for changes to fulfill short-term and long-term monetary goals.

Buy Universal Life Insurance

Some purchasers might be amazed that it offers its life insurance policy plans to the basic public. Still, armed forces participants appreciate special benefits. Your USAA plan comes with a Life Event Alternative motorcyclist.

VULs feature the highest risk and one of the most potential gains. If your plan doesn't have a no-lapse guarantee, you may also shed protection if your cash money value dips listed below a particular limit. With so much riding on your investments, VULs require constant attention and maintenance. Because of this, it may not be a fantastic option for people that just desire a death advantage.

There's a handful of metrics whereby you can judge an insurance provider. The J.D. Power consumer complete satisfaction rating is a great option if you desire a concept of exactly how consumers like their insurance coverage. AM Best's financial stamina rating is another essential statistics to think about when picking an universal life insurance company.

This is especially crucial, as your cash money value grows based upon the investment choices that an insurance firm offers. You must see what investment options your insurance carrier offers and compare it against the objectives you have for your plan. The finest way to find life insurance policy is to accumulate quotes from as lots of life insurance policy companies as you can to comprehend what you'll pay with each plan.

Latest Posts

Universal Life Policy Calculator

Iul Insurance Pros And Cons

Surrender Cost Index Life Insurance